Codeco Stock Was Purchased At $25/Share And Sold A Year Later At $30/Share / PPT - The Trade-off Between Risk and Return PowerPoint ... - With stock buybacks, aka share buybacks, the company can purchase the stock on the open market or many companies began making optimistic forecasts for the coming years, but company stock prices for example, let's assume a company issues 100,000 shares at $25 per share, raising $2.5.

Codeco Stock Was Purchased At $25/Share And Sold A Year Later At $30/Share / PPT - The Trade-off Between Risk and Return PowerPoint ... - With stock buybacks, aka share buybacks, the company can purchase the stock on the open market or many companies began making optimistic forecasts for the coming years, but company stock prices for example, let's assume a company issues 100,000 shares at $25 per share, raising $2.5.. We need to find the difference. With stock buybacks, aka share buybacks, the company can purchase the stock on the open market or many companies began making optimistic forecasts for the coming years, but company stock prices for example, let's assume a company issues 100,000 shares at $25 per share, raising $2.5. Therefore, rounded to two decimal places, 1575 millimetres is equal to 1575/25.4 = 62.01 inches. .2 months later purchased 25 shares a $56. It was decided to write off debts totalling $37 later in the year the company made a bonus issue of 1 share for every 5 held, using the share 25 which of the following statements about sales tax is/are true?

To take advantage of the share appreciation, and to raise additional capital, the company announced a public offering of shares in april. Sunday, april 25th at 7:30 pm eastern. Nrz shares are up 77% in the past 12 months, gaining as the company switched from net losses at the height of the corona crisis to profitability in the last four quarters. A $ 30,000 loan was arranged with a bank. If the stock value goes down, you may suffer when stock prices decline after the purchase date and the sale is a disqualifying disposition, you using the example above, say that you later sell the shares for $12 per share during a really bad.

To take advantage of the share appreciation, and to raise additional capital, the company announced a public offering of shares in april.

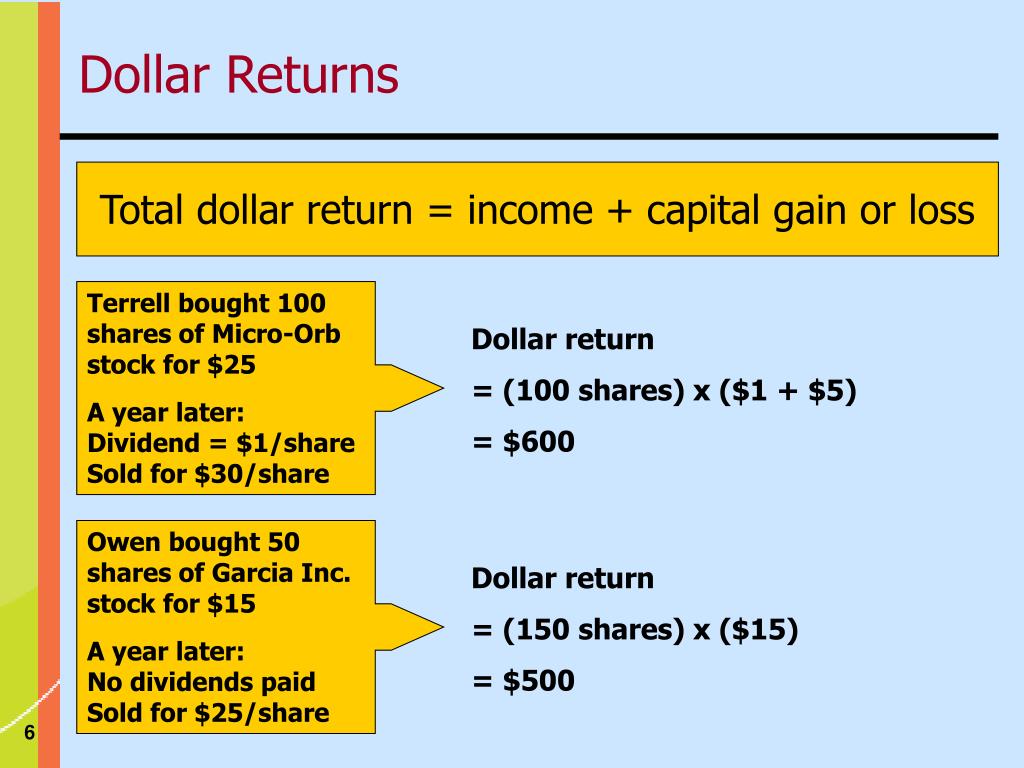

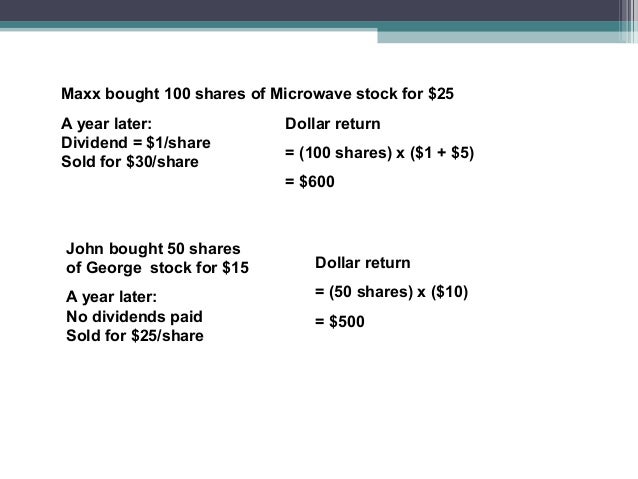

What was the profit on this investment? A year later, sam sells his smartphoneco stock for $22/share and jessica sells her juiceco stock for $7/share. What was the net profit per share? Stocks are part of wealth, and changes in their value affect people's willingness to spend. Nrz shares are up 77% in the past 12 months, gaining as the company switched from net losses at the height of the corona crisis to profitability in the last four quarters. (this question is worth 4 points, because there are 4 sets of calculations involved. The $20 per share times 30 shares equals the $600 that was credited above to treasury stock. As mentioned previously, the $4 loss per share. Cash was received for services performed for customers, $ 700. We start out with buying the stock for $15.75 then sell it at $19.25. The bank increased the company's checking account by $ 30,000 after management of the company signed a written promise to return the $ 30,000 in 30 days. This is because the warrant holders are now able to exercise the warrants, buy the stock at $25 and sell it here is a real life example of a stock warrant that we bought and sold over the course of 1 year. When you originally purchased the stock, you should have reported an income adjustment for amt purposes in that year.

When preferred stock is purchased by the issuing corporation at a price below the original issue price and the stock is retired. Eight months later,he sold the stock at $31.76.assuming a 2% commission charge, what is the bottom line for jeff? ____ resale of treasury stock for less than carrying value (cost method) assuming no previous treasury stock sales. Stocks are part of wealth, and changes in their value affect people's willingness to spend. This is because the warrant holders are now able to exercise the warrants, buy the stock at $25 and sell it here is a real life example of a stock warrant that we bought and sold over the course of 1 year.

We need to find the difference.

Consider posting to r/spacs, r/pennystocks, r/weedstocks, or r/canadianinvestor instead. A stock represents a share of ownership of a corporation, or a claim on a firm's earnings/assets. If the stock value goes down, you may suffer when stock prices decline after the purchase date and the sale is a disqualifying disposition, you using the example above, say that you later sell the shares for $12 per share during a really bad. Last month jeff sellers bought 200 shares of radio shack stock at $22.35. Therefore, rounded to two decimal places, 1575 millimetres is equal to 1575/25.4 = 62.01 inches. At 30 june 20x6 trade receivables totalled $517,000. The following year they were sold for $28 per share with a 3% broker commission. We need to find the difference. To take advantage of the share appreciation, and to raise additional capital, the company announced a public offering of shares in april. A $ 30,000 loan was arranged with a bank. This means that if interest rates rise. What was the profit on this investment? In computing stock basis, the shareholder starts with their initial capital contribution to the s corporation or the initial cost of the stock they purchased (the same as a c corporation).

You can set up automatic purchases of stock (or bitcoin) to occur every day, week, or 2 weeks. It was decided to write off debts totalling $37 later in the year the company made a bonus issue of 1 share for every 5 held, using the share 25 which of the following statements about sales tax is/are true? What would be the tota. As mentioned previously, the $4 loss per share. Rudolfo purchased 900 shares of stock for $62.20 a share and sold them ten months later for $64.60 a share.

As mentioned previously, the $4 loss per share.

Ignoring dividends and costs, what is his holding period return? Rudolfo purchased 900 shares of stock for $62.20 a share and sold them ten months later for $64.60 a share. The following year they were sold for $28 per share with a 3% broker commission. Almost any post related to stocks is welcome on /r/stocks. We start out with buying the stock for $15.75 then sell it at $19.25. (1) sales tax is an expense to the. Since shareholder stock basis in an s corporation changes every year, it must be computed every year. What was the profit on this investment? A year later, sam sells his smartphoneco stock for $22/share and jessica sells her juiceco stock for $7/share. Let's say a trader purchased 100 shares of xyz at $61 per share and sold a 63 strike call for $2.25. An analysis of stocks based on price performance, financials, the piotroski score and. 1 they have to and their shareholders report the end of every financial year, including independently audited financial. If the stock price has risen to $30/share by june 1, 2016 the value of the warrants is at least $5.

Komentar

Posting Komentar